![]()

An income certificate is an authorized certificate issued by the state government. It certifies the annual income of the family from different sources. It is required by various organizations. It is required by educational institutions, to avail pension or other government schemes or benefits. In this blog, we will provide you with a comprehensive guide on Income certificates, purpose, usage, application form, and much more.

Income refers to a person’s regular earnings or financial gain by working for an organization, labouring, or running a business. It includes an employee’s pay, different pensions, a labourer’s daily wage, weekly wage, profits from the company, consultation fees, commissions from agency work, and any other regular financial advantages received by a person. Employee bonuses, deposit interest, dividends from share and stock markets, property rent, profits on asset sales, and gifts and inheritances are the primary sources of other income.

It is a document that certifies a person’s or a family’s annual income from all sources, including salary, daily earnings, pensions, businesses, property income, rent, and remittances from foreign. It’s a government-issued official document that serves as verification of a person’s or family’s income. The official authority will issue an income certificate after reviewing the applicant’s application, affidavit, and any supporting papers. It is required to get financial help from the government or a seat reservation in educational programs.

It is an official document that serves as verification of a person’s or family’s income, it is a mandatory document. Some educational institutions require certificates as proof of finance. It is also necessary for tax reduction, government services, and even purchase a property. Students can also use their income certificate to apply for scholarships or fee concessions for their higher education or while applying for school/college entrance. The following are some of the potential uses for an income certificate:

To obtain an income certificate, here are the mandatory documents that you will be required to submit along with the application form:

Important Note: When applying at a Citizen Service Centre (CSC), the beneficiary must produce a self-attested copy of the original document, and if applying online, the document must be uploaded into the e-District application software. Even in the case of online applications, physical verification of some papers may be required at the counter.

Important Note: Scanned copy of Self-declaration has to be uploaded while applying online and original declaration has to be submitted to the concerned SDM/Tehsildar/CSC by hand or speed post/registered post along with Application Acknowledgement number.

It is issued by the official of different state governments. Check out the following government officials who issue certificates of income depending upon the location of the applicant:

An application for a certificate should be submitted to a government-appointed authority which varies by state. Many Indian states select the Tehsildar as the authority to issue Income Certificates while in some states the District Magistrate, District Collector, Village Officer, or other government-appointed official issues the certificate. The eligible applicant can apply using the following steps given below for Delhi residents:

The following is a full list of the authorities that issue income certificates in various states and union territories:

If you wish to get a Certificate of income for a specific reason, first check to see if the required purpose information/prospectus has a format for it. For example, most educational programme entrance prospectuses will include a common structure for applying for an Income Certificate. If there are no particular instructions, you can use a printed form that is accessible at the above-mentioned Authority office or download it from the websites. Furthermore, several states have implemented eDistrict online services, which allow for the hassle-free submission of a variety of services, including requests for these Certificates.

The structure and information in a standard certificate of Income application should be as follows:

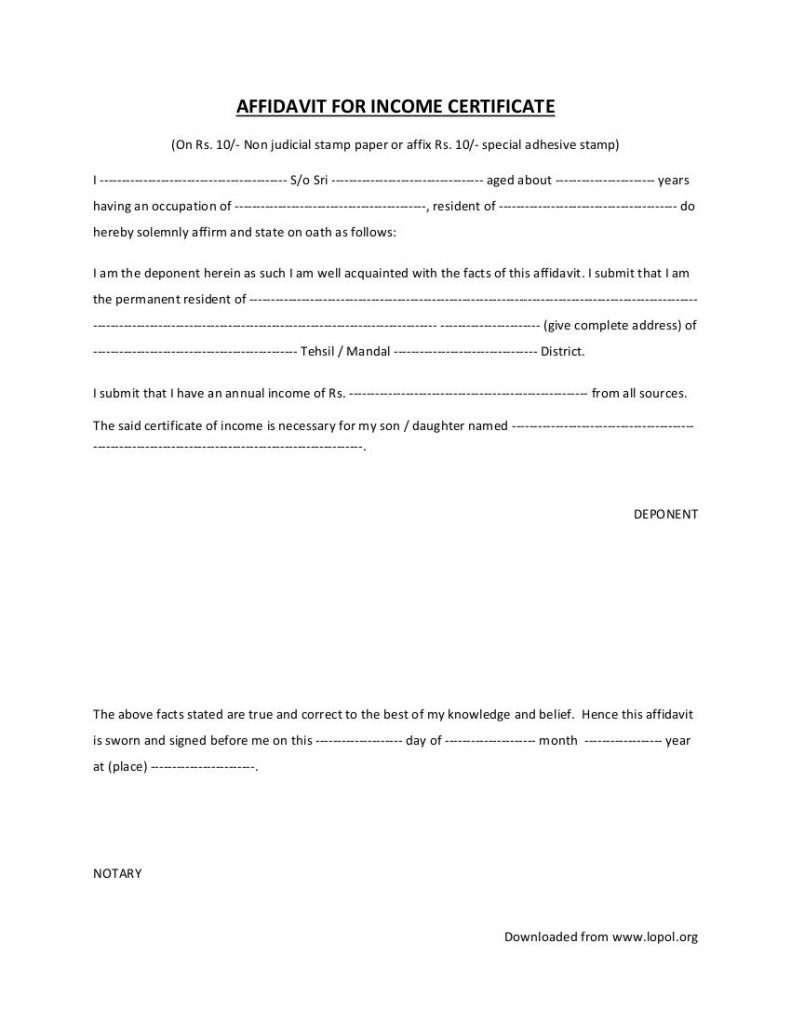

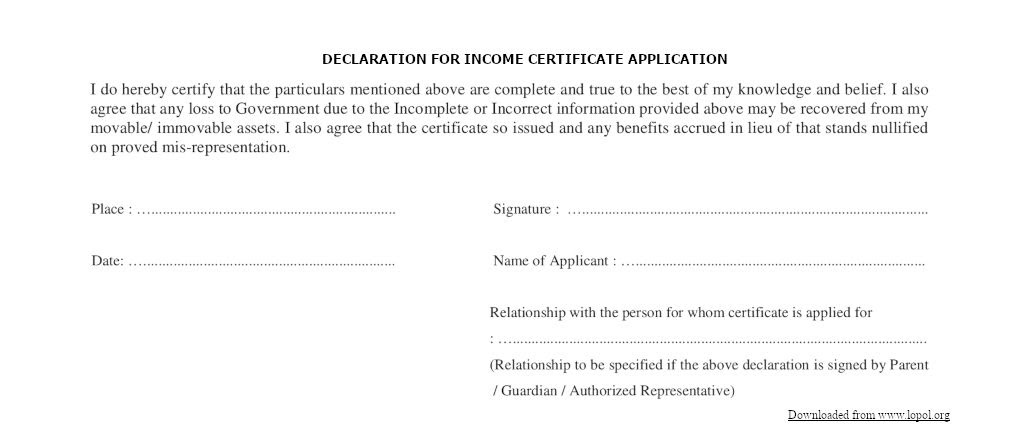

The Declaration and Affidavit for Income Certificate to be attached along the Income Certificate are shown in the images below.

When applying for this document, any government-issued identity/address evidence (including Aadhaar) can be used as supporting documents. PAN, Voter ID card, Ration Card, and other government-issued ID cards are some examples.

What is the validity of an income certificate?In general, they have a one-year validity term from the date of issuance. The validity periods for certificates vary by state and administrative division, ranging from three months to four years.

I am a Delhi resident. Is it possible to obtain an income certificate in Haryana?No, It is provided by the state government, you can only get one from the state where you live. As a result, an income certificate may only be obtained by a Haryana resident.

The previous time I applied for an income certificate, it was denied. Is it necessary for me to reapply?

The most common causes for an income certificate application being rejected include improperly filling out the application, failure to provide supporting documents, and ineligibility to get an income certificate. While you should absolutely consider reapplying if one of the first two reasons for your application’s rejection was the reason, reapplying if you are ineligible for an income certificate in the first place is not a smart idea.

In 2017, I got my income certificate. Is it necessary for me to keep my old certificate in order to reapply?

No, you do not need to submit your old certificate when applying for a new one. Old certificates, on the other hand, must be kept for a period of 5 years after they were issued in order to verify your eligibility for any and all programmes you use the certificate for at a later date.

Is there a difference between an income certificate and an agriculture income certificate?No, an agriculture certificate only provides information of revenue earned as a result of involvement in any and all agricultural operations, whereas an Income Certificate includes details of annual income from all sources.

This was all about the Income Certificate. Be extremely careful while filling the income certificate application form and re-check before submitting it. Stay tuned with Leverage Edu for more informational content around the world.