This form should be completed and signed by the owner and contractor, where applicable, to attest that there are no outstanding invoices on the completed project, and that all liens have been dismissed or any future lien rights are otherwise waived. The affidavit further requests that the insurer issue a policy based on these affirmations. A Certificate of Completion for an insurance company is an official document that signifies the successful completion of a specific insurance course, training program, or continuing education credits. This certificate serves as proof that an individual, typically an insurance agent or professional, has gained the necessary knowledge and skills required to work in the insurance industry. Insurance companies often require their employees to obtain certain certifications or complete relevant courses to ensure compliance with industry standards and regulations. Keywords: certificate of completion, insurance company, insurance agent, training program, continuing education credits, industry standards, compliance, regulations. Different types of Certificates of Completion for insurance companies could include: 1. Insurance Agent Certification: This type of certificate indicates that an individual has successfully completed all the requirements to become a certified insurance agent in their respective jurisdiction. It demonstrates their knowledge of insurance policies, regulations, and sales techniques. 2. Continuing Education Credits Certificate: Many insurance companies mandate their employees to complete a certain number of continuing education credits each year. A Certificate of Completion is awarded for successful participation in these ongoing training programs, which keep insurance professionals updated with the latest industry trends, regulations, and best practices. 3. Specialized Insurance Training Certificate: Insurance professionals often pursue specialized training programs to enhance their expertise in specific areas, such as health insurance, life insurance, property and casualty insurance, or risk management. Successful completion of such training programs results in specialized certificates that validate the individual's skills in those specific insurance domains. 4. Insurance Compliance Training Certificate: This certificate signifies that an insurance agent or employee has successfully completed training on regulatory compliance within the insurance industry. It demonstrates their understanding of laws and regulations pertaining to insurance practices, ethics, and legal responsibilities. 5. Claims Adjuster Certification: Some insurance companies require their claims adjusters to undergo specific training and obtain a specialized certification. This certificate acknowledges the adjuster's expertise in assessing and processing insurance claims accurately, fairly, and efficiently. It is important for insurance professionals to maintain a record of all their Certificates of Completion as evidence of their commitment to professional development and compliance with industry standards.

A Certificate of Completion for an insurance company is an official document that signifies the successful completion of a specific insurance course, training program, or continuing education credits. This certificate serves as proof that an individual, typically an insurance agent or professional, has gained the necessary knowledge and skills required to work in the insurance industry. Insurance companies often require their employees to obtain certain certifications or complete relevant courses to ensure compliance with industry standards and regulations. Keywords: certificate of completion, insurance company, insurance agent, training program, continuing education credits, industry standards, compliance, regulations. Different types of Certificates of Completion for insurance companies could include: 1. Insurance Agent Certification: This type of certificate indicates that an individual has successfully completed all the requirements to become a certified insurance agent in their respective jurisdiction. It demonstrates their knowledge of insurance policies, regulations, and sales techniques. 2. Continuing Education Credits Certificate: Many insurance companies mandate their employees to complete a certain number of continuing education credits each year. A Certificate of Completion is awarded for successful participation in these ongoing training programs, which keep insurance professionals updated with the latest industry trends, regulations, and best practices. 3. Specialized Insurance Training Certificate: Insurance professionals often pursue specialized training programs to enhance their expertise in specific areas, such as health insurance, life insurance, property and casualty insurance, or risk management. Successful completion of such training programs results in specialized certificates that validate the individual's skills in those specific insurance domains. 4. Insurance Compliance Training Certificate: This certificate signifies that an insurance agent or employee has successfully completed training on regulatory compliance within the insurance industry. It demonstrates their understanding of laws and regulations pertaining to insurance practices, ethics, and legal responsibilities. 5. Claims Adjuster Certification: Some insurance companies require their claims adjusters to undergo specific training and obtain a specialized certification. This certificate acknowledges the adjuster's expertise in assessing and processing insurance claims accurately, fairly, and efficiently. It is important for insurance professionals to maintain a record of all their Certificates of Completion as evidence of their commitment to professional development and compliance with industry standards.

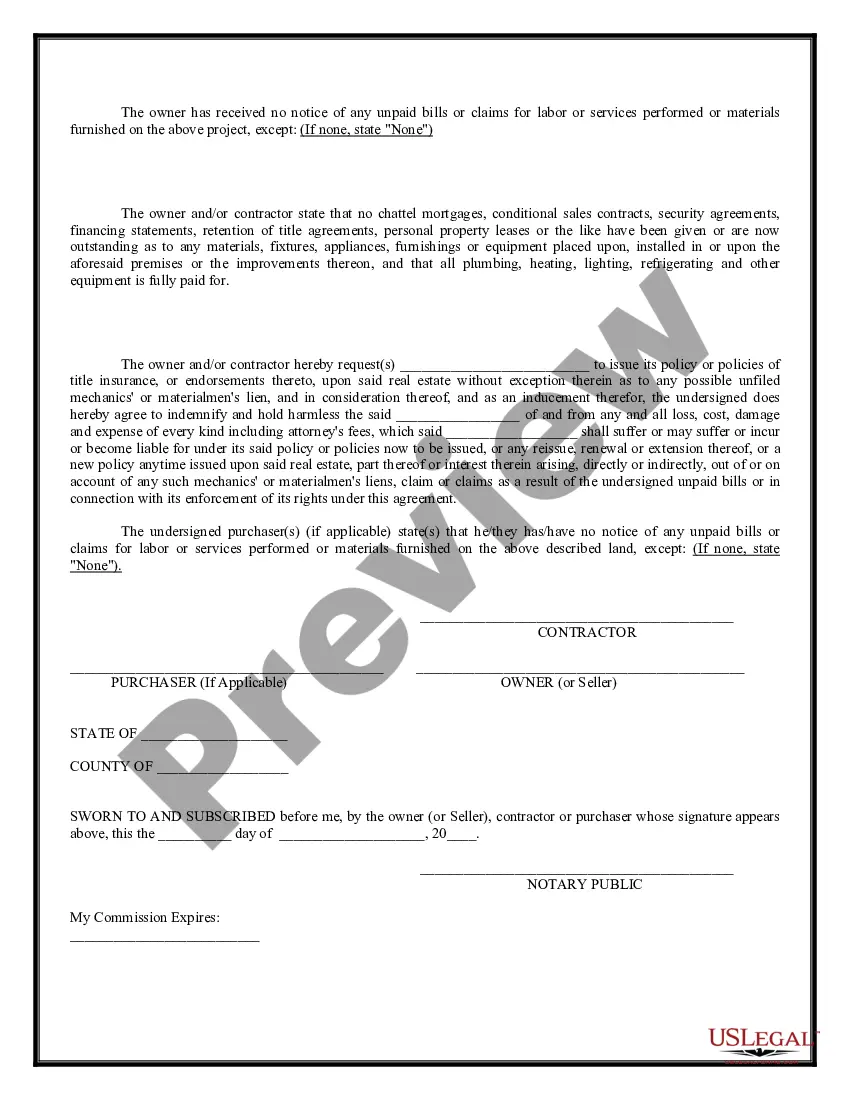

Free preview Subcontractors

Legal document managing can be overwhelming, even for the most experienced specialists. When you are searching for a Certificate Of Completion For Insurance Company and don’t have the a chance to commit in search of the appropriate and up-to-date version, the processes can be stressful. A robust web form catalogue could be a gamechanger for everyone who wants to manage these situations efficiently. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you may:

Help save time and effort in search of the documents you need, and employ US Legal Forms’ advanced search and Review tool to find Certificate Of Completion For Insurance Company and acquire it. In case you have a subscription, log in for your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to view the documents you previously downloaded and to handle your folders as you see fit.

Should it be your first time with US Legal Forms, create an account and get unlimited usage of all benefits of the platform. Listed below are the steps to consider after accessing the form you need:

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Transform your daily document administration in to a smooth and easy-to-use process right now.